| At December 31, Folgeys Coffee Company reports the following results for its calendar year. |

| Cash sales | $ | 903,000 |

| Credit sales | 303,000 | |

| Its year-end unadjusted trial balance includes the following items. |

| Accounts receivable | $ | 128,000 | debit |

| Allowance for doubtful accounts | 5,300 | debit | |

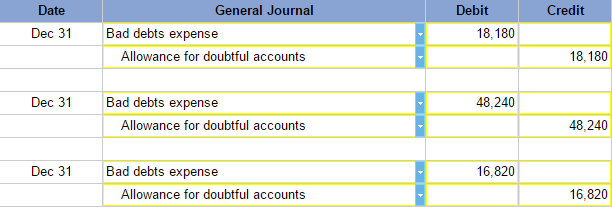

Prepare the adjusting entry to record bad debts expense assuming uncollectibles are estimated to be (a) 6% of credit sales, (b) 4% of total sales and (c) 9% of year-end accounts receivable.

| |

| a. |

| Bad debts expense $303,000 × 0.06 = $18,180 |

| b. |

| Bad debts expense [($303,000 + $903,000) × 0.04] = $48,240 |

c.Bad debts expense:

| Unadjusted balance | $ | 5,300 | debit |

| Estimated balance ($128,000 × 9%) | 11,520 | credit | |

| Required adjustment | $ | 16,820 | credit |

No comments:

Post a Comment